Are You Living Paycheck to Paycheck?

Have you ever wondered why you are struggling with your finances? You are not alone.

““78% of full-time workers said they live paycheck to paycheck, up from 75% last year (2016). Overall, 71% of all U.S. workers said they’re now in debt, up from 68% a year ago”, according to a recent report from CareerBuilder.”

This baffles my mind and breaks my heart to see so many Americans, living on the edge of financial ruin.

I recently listened to the audio book “The Richest Man in Babylon” by George S. Clayson. This was originally published in 1926. I was worried that there might not be much for me to learn from this book, but I’m always looking for ways to expand my knowledge base, so I checked the audio book out from my library. After listing to the book, I was pleasantly surprised by the amount of wisdom shared on managing one’s personal finances.

The analogy that most hit home with me was the following: The wealthiest man in Babylon (mentor) says... "I found the road to wealth," "When I decided that a part of all I earned was mine to keep. And so will you." The mentor in the story asked his students if they went to their chicken house every day, and pulled out 10 eggs each day, but only ate 9, what would eventually happen? A student then replies that the basket of eggs would soon be overflowing. The moral of the story is to simply pay ourselves first a minimum 1/10th of our income. By doing so, over time, our reserves will be overflowing with money.

This is a simple concept, but very difficult for most of us to live by.

Over the years I have had many conversations about money with friends and family. My friends and family that are struggling the most financially, are the ones who spend their bonus or tax returns right a way on new furniture, a new car, or something else that doesn’t advance their financial position in life. Those that seem to be doing well (their incomes sometimes much less than those that are struggling), are able to live off of 90% of their income or less.

There are many economic issues at play in the background that may be affecting the ability of the middle class to save money. However, I like to focus on the things that we can control directly. We have the power to live on just 90% of our income. For example, last year I was able to live off of 58% of my take home pay and save the other 42%. This was not a good year for me either. I had over $7,000 of out of pocket medical expenses. The year before my medical expenses were only around $200. How do I know how much I saved? It’s because I track my spending down to the dollar. Budgets have never worked for me, but TRACKING what I spend gives me motivation to try and save more. I like to see if I can beat last year’s savings, or hit a financial milestone.

Below are my actual spending numbers for 2017 by month:

This is what I spent of my take home pay after everything was taken out of my paycheck including Taxes, 401K contributions, Long Term Disability Insurance, and Health Insurance. If you count in my 401K savings, my savings amount increases even more. You can see months where my healthcare expenses were huge, where I had to dip into my savings to make it through the month. Another tactic I used, was having a roommate to share expenses with. You can see the difference that made in my housing costs. It also helped with my food as we split food, and decided to cook from scratch almost all the time. What a huge difference that made!

So for those of us just starting to learn to live on less than we earn, start with a 5% goal. To understand where you need to cut back, you will need to know where your money is going. Start by tracking your money for at least two months to know roughly where your money is being spent. It’s best to track your money for the rest of your life, as each year you will get better and better at understanding your money and how it moves. Once you have mastered the first 5%, then you can work on setting your sights higher.

The trick is to then make sure the money that you have paid yourself (savings) is then producing children and grandchildren. Your money should be working to make you more money. Simple examples could be mutual funds in your 401K or Roth IRA, or a rental property that you own, or a business that you purchase. All of these items are ASSETS, which means that they will return money to you after purchase. Furniture, clothes, cars, jewelry and other items will rarely if ever pay you back, and if you do end up selling them, it will be for far less that you purchased them for.

So let's run some basic scenarios. Say you earn $40,000 take home pay after your 401K contributions, health insurance premiums, taxes and other work deductions. If you are able to save $4,000 (10%) each year, after 10 years you will have $40,000.

Scenario #1:

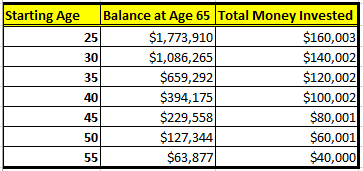

Invest $333.34 ($4,000/12 = $333.34) a month in a simple ROTH IRA until you are 65 years old. Projecting a standard 10% return your estimated savings would be the following:

As you can see, the earlier you start with this 10% savings the more babies your savings makes for you (AKA, the better return on your investment).

Scenario #2:

You save for 10 years and put the money towards buying a small business. This could be a franchise or a business idea you have which you build from scratch. The difference between working for someone else and working in your own business, is you will have an asset at the end of the day. Buying or starting a business from scratch, will not only give you a salary through your working years, but also leave you with an asset that you can sell when you retire. If you save like you normally would in your retirement accounts, whatever you sell your business for will be just gravy. For example, if you use the $40,000 you save over 10 years to start a construction business, which you grow to $4,000,000 in total revenue in the next 10 years, and then sell that business for $1.5 million, you would be far ahead of your $40,000 take home job.

Scenario #3:

You use 10 years worth of savings to put a 20% down payment on a $200,000 rental property. The rent money pays the mortgage and upkeep of the home. After another 10 years, you put another 20% down on another home, and then the property snowball begins. Let’s say that after 30 years, you have three paid for rentals. The $200,000 properties are now worth $400,000 or a total of $1.2 million. Your total cash contributions would have been $120,000. Again, making your money work for you to create more money. You give $120,000 and receive $1.2 million.

The above scenarios are very simplistic and don’t account for many things, like inflation, business valuation variances, taxes and exact property appreciation. However, the purpose is to give you a general idea of how you can turn your simple 10% saved into some serious money. Dream big, plan ahead, and get excited about your finances again! The future is bright and you have the power to stop living paycheck to paycheck. You can still prosper in the United States today!