How Much is Your Retirement Costing You?

Recently while purging some old personal financial documents, I came across my old paperwork for my Edward Jones account. Back in 2009, I rolled my 401k into a simple IRA with Edwards Jones and had it with them for 8 years. While going through my documents I happen to notice the fee page. This page is on the 7th of 8 pages explaining my IRA and mutual funds with them. The “program fee” is set at 1.35%.

Woman looking at the stock market returns for the day.

For some of you that may seem like a tiny amount. I mean, they are managing your money and only getting 1.35%. However, after reading “The Little Book of Common Sense Investing”, by John C. Bogle, I realized what little benefit if any I receive of this “management” fee that I paid. Also, the concept of compound interest can make this seemingly small fee explode into real wealth lost.

In 2017 I decided to invest in S&P 500 Index Funds at a fee rate of .09%. The S&P 500 has generally out performed managed mutual funds and so paying such a high price for managed mutual funds doesn’t make sense to me. According to research released in 2017 from Standard and Poor’s:

““Over the last 15 years, 92.2% of large-cap funds lagged a simple S&P 500 index fund. The percentages of mid-cap and small-cap funds lagging their benchmarks were even higher: 95.4% and 93.2%, respectively.

In other words, the odds you’ll do better than an index fund are close to 1 out of 20 when picking an actively-managed domestic equity mutual fund.”

”

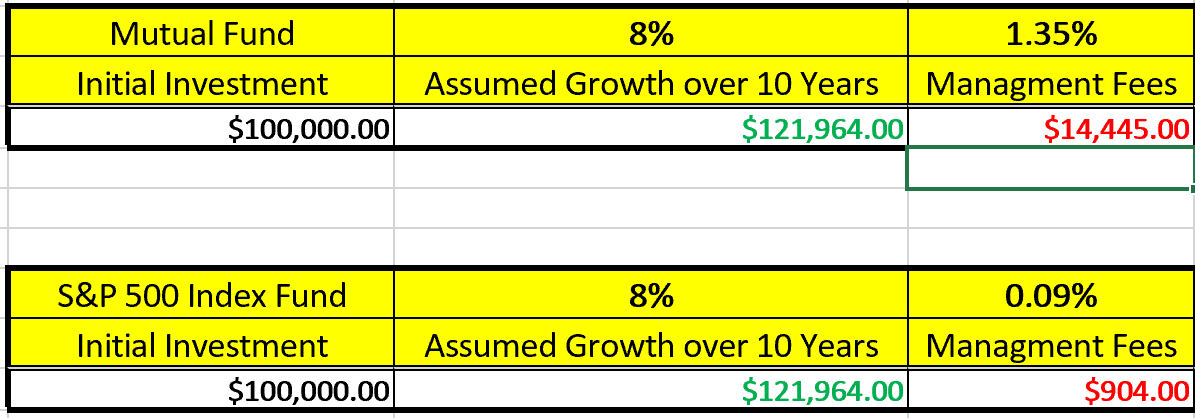

For easy math, lets take $100,000 invested in these “managed” mutual funds provided by Edward Jones and most 401K providers. To make things easy, let’s say that this account stays exactly at $100,000 the entire time, and that the investor never contributes to the account. After just 10 years of “management” fees, the “financial advisor” would receive $14,444.99 of your retirement funds.

I don’t know about you, but paying $14,445 for worse performance than the $904 S&P 500 unmanaged stocks, seems like a really silly thing to do.

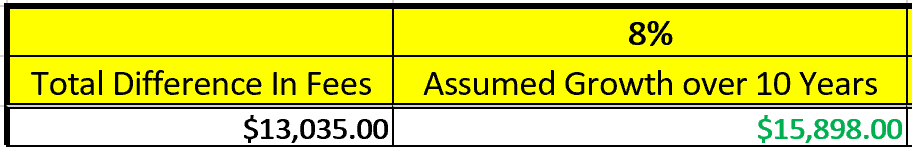

Now let’s take a look at what we would earn if we invested the difference between the above listed fees of $13,035 for another 10 years with an 8% assumed return:

That's another $15,898 of growth lost out on because of fees. Again these calculations were kept very simple, but you can imagine what the fees would be if I had calculated the accumulating compound interest and the lower return on investment with the mutual funds.

Man pulling money out of his wallet.

Simply said, paying roughly 15 times the amount in fees for a lower return makes moving your retirement funds from managed mutual funds to the S&P 500 index funds a no brainer. Take time to contact your company’s 401K provider or your IRA manager and find out if you can put your investments into S&P 500 index funds. The longer you wait, the more fees you have to pay for underperforming mutual funds.